Cathy McBeth Email

VP, Portfolio Operations . Investors In Middle Market Growth Buyouts

Seattle, WA

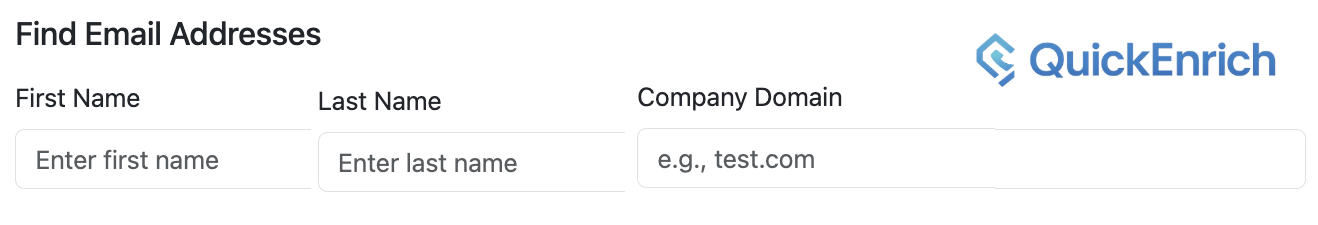

LocationPrimary Email

How to contact Cathy McBeth

Join and see Cathy's contact info for free!Current Roles

Employees:

17Revenue:

$3.5MAbout

Based in Seattle, Pike Street Capital is a private equity firm focused on lower middle market growth buyouts. Pike Street invests in successful businesses in industrial and other sectors that serve professional customers. We are especially attracted to investment partnerships where our operational focus, expertise and executive network can assist management to accelerate growth. We have deep experience partnering with management teams, families, and founders to achieve their objectives from continued growth to business transition. We have accumulated a set of experiences, tools and relationships that make us a helpful partner and investor. With our Pike Street Operating system (which we call S2E), we help management teams tackle new sectors of growth, expand geographically, enhance go-to-market systems and accelerate product development. We believe growth is a process and a team sport. We are a hands-on resource to help management expand, grow and further professionalize their business. Our typical investment will have between $4 million and $20 million of EBITDA and revenue between $20 million and $200 million. We look for majority investment positions. Since we are growth oriented, we seek to avoid excess financial leverage to ensure our investments can capitalize on growth plans and opportunities.Investors In Middle Market Growth Buyouts Address

114 NW Canal StSeattle, WA

United States